How to Know Which Type of Loan You Need

It’s time to think about a home for you and your family, but you don’t know where to start because you’ll need a loan to even begin the process of moving and finding a home.

You aren’t sure if you should buy a home, lease a home, rent an apartment, or maybe you want to sell your current place to move, so where do you begin? Especially when you need a loan to be able to move into your home.

First things first, you must choose your location, price range, consider all personal questions such as how far is the nearest school for your child, or what type of neighborhood is it in?

All of these personal preferences must be thought out and even wrote down or mentally noted before searching for somewhere to reside.

Once you’ve thought out all of your personal preferences, it’s time to decide whether to buy, rent, or lease a home/apartment. And then of course, you have that option to sell your home Obviously, selling your home to move elsewhere would be an obvious decision for those with homes to sell and ready to move into somewhere new.

We’ve gathered up some great information from professionals and those who’ve lived through it alike so that we can help you when you come to Properties Miami looking for your next home.

Questions to Ask Yourself When Choosing a Loan

Renting, buying, or selling?

Selling to move

If you are 100% serious about selling your home, you’re going to have to put in some work. It’s certainly not just about telling everyone your house is for sale and you’re done, especially when you’re looking for a loan. Here are some steps and a checklist to go over should you decide selling your home is best for getting the loan.

- Find a good real estate agent. The good news is, that is where Properties Miami will come in, as they make sure to set you up with an amazing real estate agent who works just for you.

- Consider the looks of your home. While looks aren’t absolutely everything, they do mean a lot when it comes to selling/buying a home. Make sure the buyer’s first impressions are positive, just by looking at your home. Everything else will follow.

- Declutter your stuff. Take your stuff and give it to the needy or homeless, have a yard sale, but whatever you do – declutter!

- Depersonalize your home. You’ve had all of these years to make this place your own, now it’s time for someone else to do the same. Make sure you have removed anything that would distract the buyer’s attention, you want them to be able to see themselves in your home and they wouldn’t really be able to do that with pictures of your family everywhere.

- Repaint and fix up any loose, broken, damaged, or really just any part of the home that needs it. You don’t want to try and sell your home and lights don’t work, that’s not a good look. Fix it up first.

- Clean, clean, clean. And when you think you are done, clean some more. Then make it smell good with candles, scented plugins, and other light smells but don’t overpower anyone with the smells.

- Hide your valuables. Obviously, you don’t want anything in the house important to you showing for everyone to see …and possibly take.

- Do a walkthrough with a friend. Have your friend pretend they are either the homeowner or the buyer, and you as the opposite, or you could even both play both parts. Do the walkthrough together, as if you are really selling your home. Know the key points to hit and have your friend ask questions, on both ends, so that you can prepare for anything. Plus, doing this walkthrough with someone else too will allow both of you to find anything that might be wrong or missing.

Buying or renting?

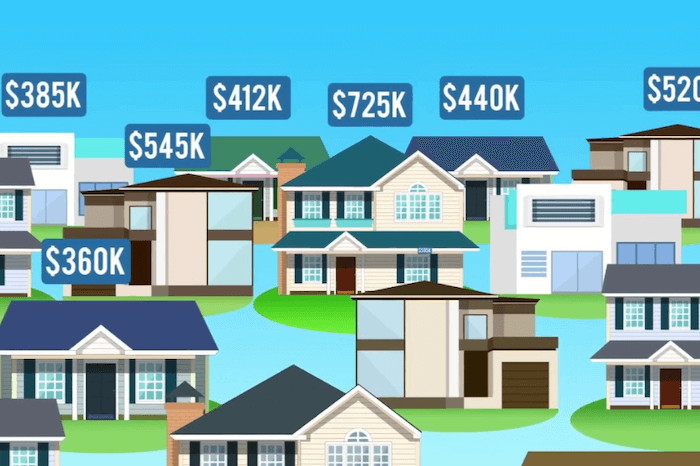

The biggest argument about buying a home as opposed to renting a home is the end cost. Some say that renting is more expensive and others say that buying will be more expensive, but the truth is that both can be a pretty penny in the long run.

So when you decide whether to buy or rent, there are several mitigating factors that should be thought of when making this tough decision. How much money do you have upfront? Are you looking for something long-term or shorter-term? Do you have animals or loud cars/bikes that could potentially keep you from renting in certain areas?

There are tons of factors to think about and especially when it comes to renting, these places are a little more strict in who they take in.

For instance, if you have tons of money and five, loud barking dogs, your best bet is definitely buying a home, but if you live alone and you make about $800 per month, you would be better off renting a home. Now, if you fall somewhere in the middle you really just have to weigh the pros and cons of each to figure out which would really suit your life at this moment in time the best.

Five questions to ask yourself when choosing to rent or to buy:

- What can you afford?

- How long are you wanting to stay in this place?

- Are you looking for more stability or flexibility?

- Do you want to be responsible for home repairs, lawn care, etc?

- What are your financial, career, and family goals for the near future and even in 10 years?

Purchasing or refinancing?

One of the biggest questions to ask yourself when looking for a new place to stay and a loan to accompany this thought is if you want to purchase or refinance. This is mainly for mortgages and for home loans. Let’s take a look at what each one means for you so that you can decide which one would really be best for you.

Purchasing home loan

You would want to inquire about a purchase loan when you need to borrow money from the mortgage lender in order to buy that new place you’re eyeing.

Refinancing home loan

A refinancing loan is when you already have a mortgage loan and you would like to refinance the existing loan into a new one.

Things to Consider When Choosing a Loan

Calculate how much you can afford

As we said numerous times in the article, one of the biggest factors, if not the biggest factor, is certainly how much money you’d like to put towards a down payment. Remember, when renting you’re going to need a down payment of usually the first months to rent whereas if you choose to buy a home, you’ll probably need double the money to put down and secure your spot.

Set realistic goals

Buying or renting a home is a huge deal, and it’s certainly not something you should toy around with. You have to set realistic goals for yourself, your family depends on it.

Consider the length of your mortgage

Some mortgages are six months, others a year, and then you can find some that are over several years. Don’t get caught up in a mortgage you won’t be able to handle later on down the road. A mortgage is almost like a contract binding you in, so make sure if you’re going to be bound you’re where you want to be.

Choose the loan that is right for your situation

If you know you’re just looking for something right now, and you have only a few hundred bucks to your name, it’s totally OK to say “ok, this is my situation and this means I should probably rent instead of buying”, it’s super important to know and understand your situation, and base that on whether or not to buy.

Understand how your interest rate works

Interest rates are something we all hate, but they’re also going to be there if you get a loan. Interest rates are there to charge you even more than you are already paying, and they’re based on a percentage of what you’ve borrowed. Calculate everything out correctly and make sure you know how your interest rate works before diving into a sale.

Ask questions

Always, always, always ask questions – and there is never a dumb one. If someone says you asked a dumb question then that probably means they are too dumb to answer it.

You have the right to know 1000% of every single answer to every single question you have about buying, selling, or renting and obtaining that loan. You don’t have to do anything blindly. Ask questions, and ask lots of them.

Know your long-term plans

We vaguely touched on this before, but you’ll want to know your long-term plans for yourself and your family, or whoever will be living with you, just as much as you want to be aware of your short-term plans. Knowing what you want out of your future is going to help you determine what you want out of your home in the future as well.